A Chinese cryptocurrency enthusiast has tested the capabilities of Nvidia's latest top-of-the-line specialized GPU, the CMP 170HX.

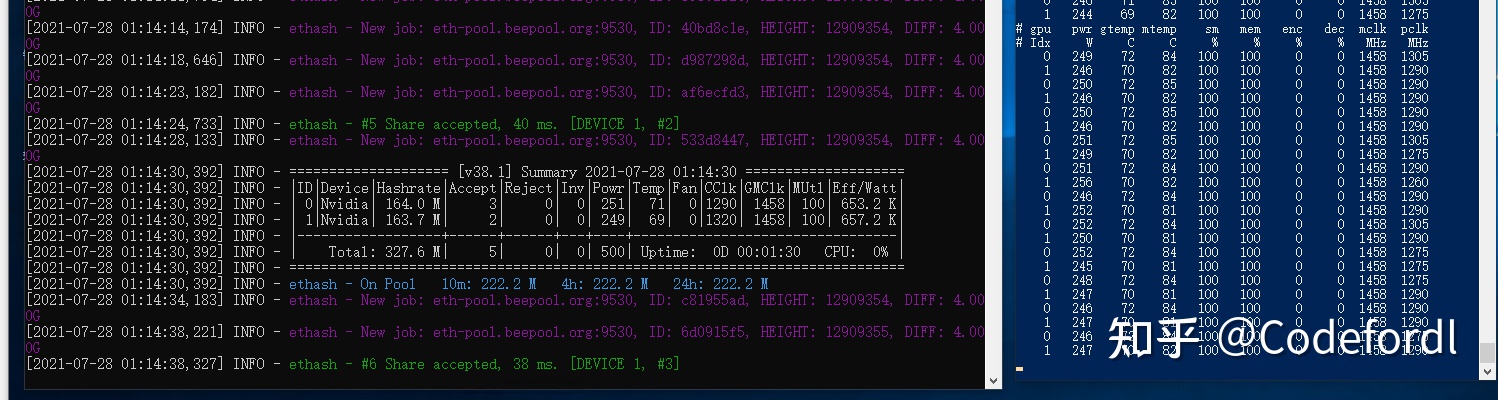

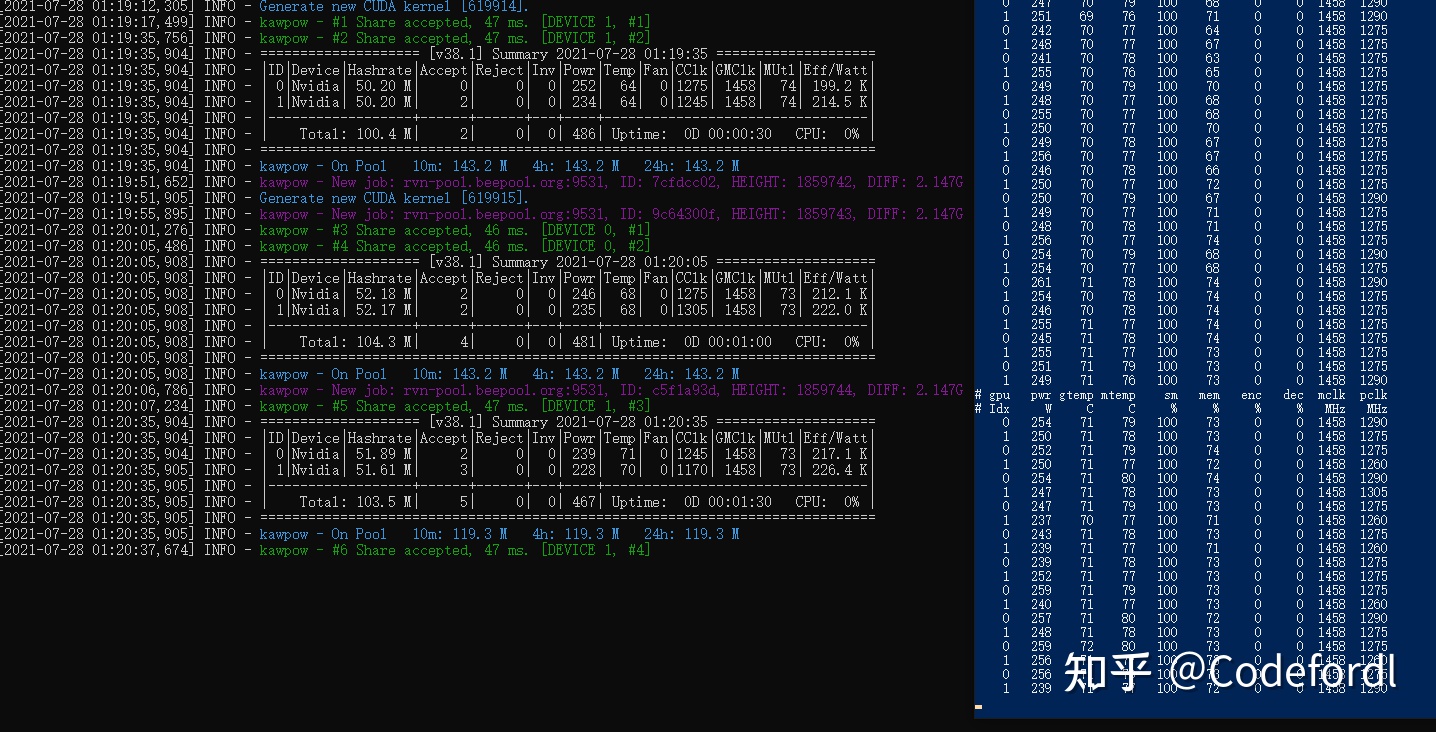

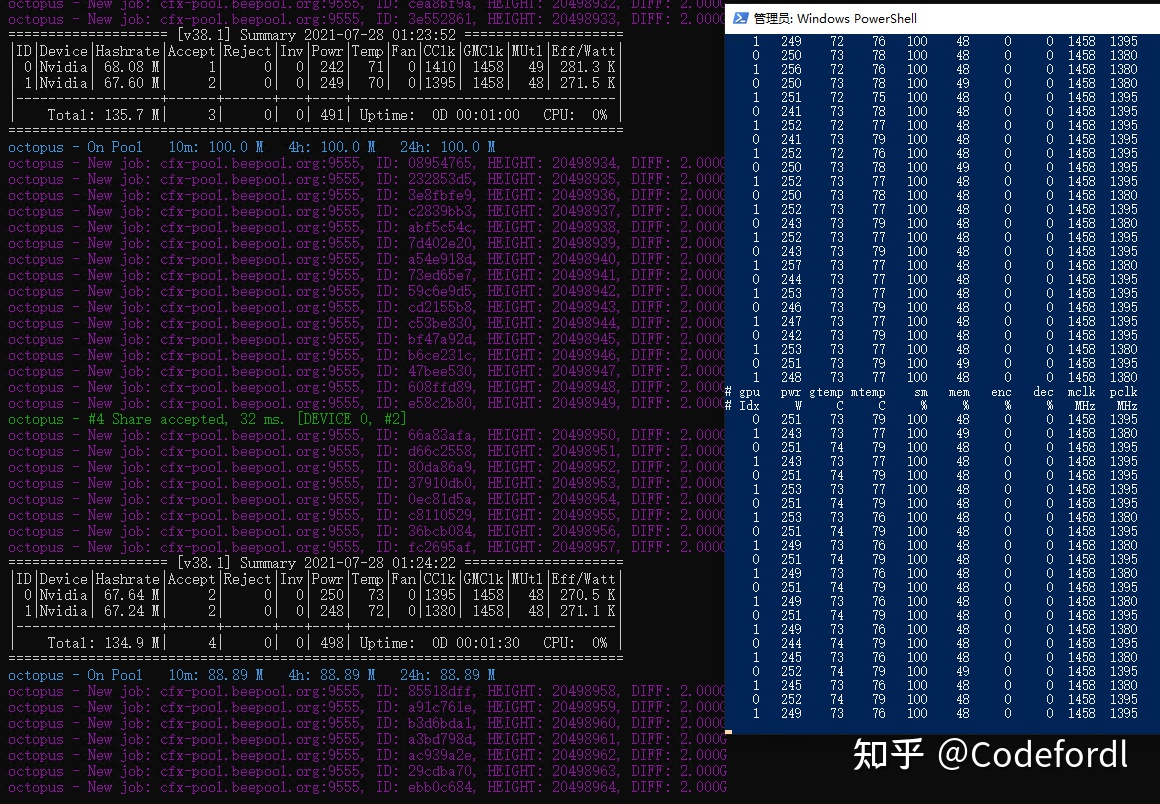

To explore the device's capabilities, the miner used Ethash, Kawpow and Octopus algorithms to mine Ethereum, Ravencoin and Conflux, respectively.

So far we know the GPU will have the following specs (No details about sales launch yet):

8GB HBM2 memory with a 4,096-bit bus and up to 1.5Tb/s bandwidth;

Will be based on a downgraded version of Ampere A100;

4 480 CUDA cores;

Processor speed 1,140-1,410 MHz;

Passive cooling system;

CUDA core frequency drops when the device reaches 70 degrees Celsius.

With the Ethash algorithm, 164 Mh/s hashrate and 250W power consumption, the gpu can bring in 15 USD/day, 450 USD/month or 5,400 USD/year, respectively, at a cost of no more than 0.04 USD per 1 kWh. Payback period in this case (taking into account fluctuations in the exchange rate of ETH, the pool commission, etc.) will be about 3.3 months, if the price of the device will be equal to 1,500 USD.

If we turn on the energy-saving mode (158 Mh/s, 190 W), we get 5,220 USD per year and an increase in payback period to about 3.5 months in case of Etherium mining.

With the KawPow algorithm (for Ravencoin mining) we have 52 Mh/s at 240W power consumption. Thus, at a price of 4 cents per kW you can count on the following profit: 7 USD/day, 210 USD/month, 2 520 USD per year. The payback period is on average 7 months. As the tester himself says, the performance of the core in this case is the bottleneck.

With the Octopus algorithm (for mining Conflux) the gpu is able to achieve 68 Mh/s at 250 watts. This is only 4.2 USD per day, 126 USD per month or 1,510 USD per year. In this case the payback increases to 1 year.