During the crypto winter users experience mixed feelings. On the one hand they want to buy new energy efficient, profitable ASIC models, while on the other there is a desire to squeeze the maximum performance out of the existing devices before the bitcoin halving happens and to create a strong investment portfolio in front of the upcoming “to the moon” cryptocurrency rates. So what do experienced miners suppose to do with their current ACIS devices?

We will start with a review of the most popular ASIC models and then we will build the economic model of each solution efficiency for February 2019.

In October 2018, the Chinese vendor Ebang Communication introduced another device to the market - the Ebang Ebit E11 ++ miner. The first batch supposed to reach customers until the mid-February 2019. As for the next batch it should be available by the end of March 2019. By the end of January, the Ebang miner was considered as the most profitable for the SHA-256 algorithm (according to asicminervalue.com).

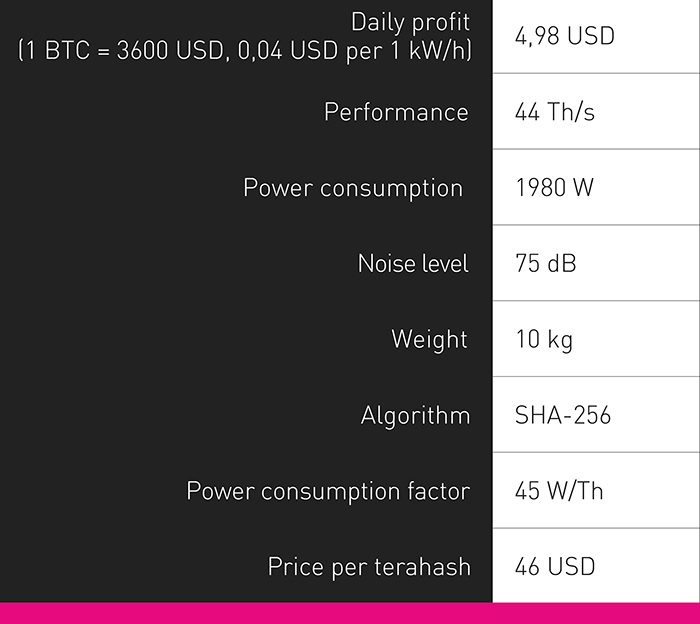

.jpg) The main characteristics of the Ebang Ebit E11 ++:

The main characteristics of the Ebang Ebit E11 ++:

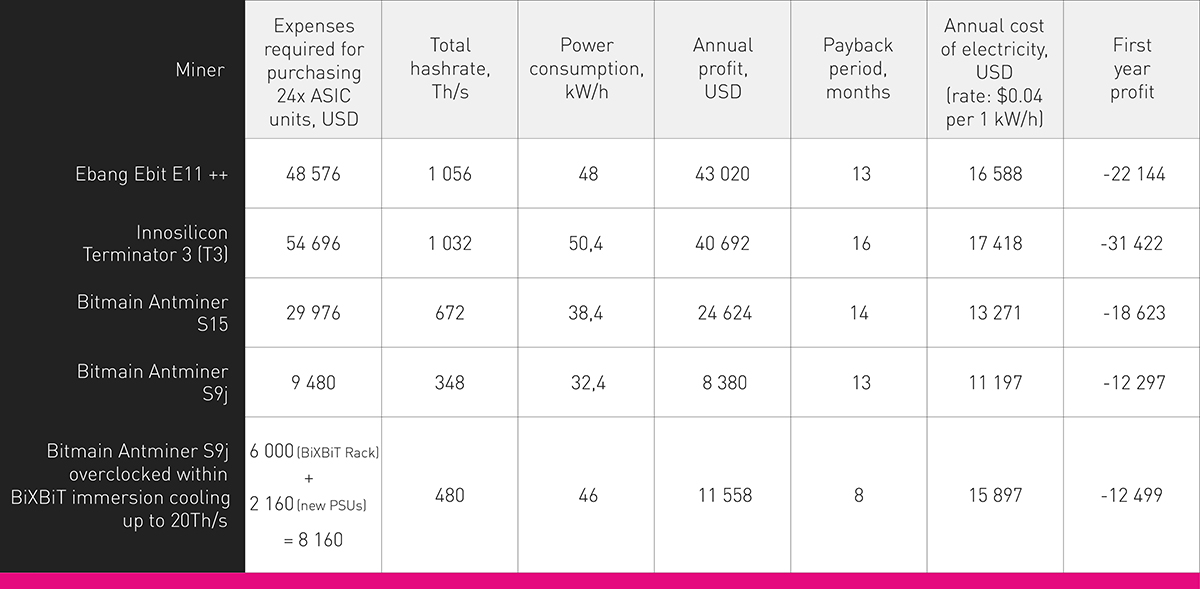

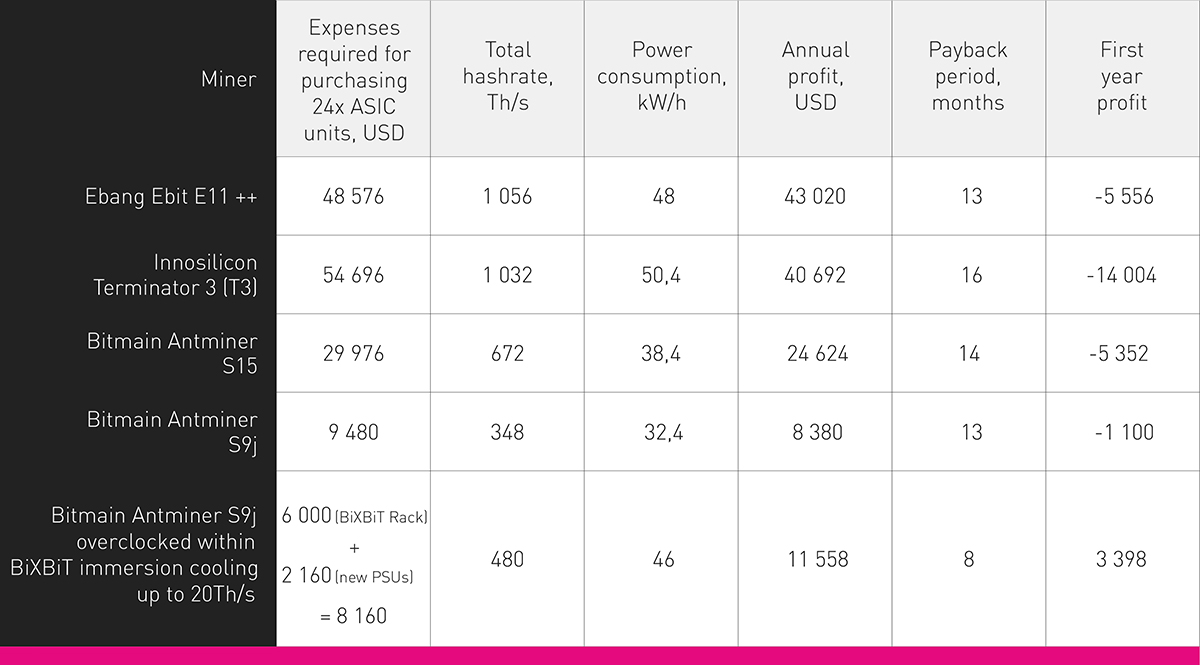

Considering a 4 cents per 1 kW/h, a monthly profit from one miner equals $149,4. Let’s take a closer look at monthly profit and payback period of 24x ASIC Ebang Ebit E11 ++:

24 x $149.4 = $3585 is monthly profit from 24 devices.

The cost of one Ebang Ebit E11 ++ device on the manufacturer’s website equals $2024, that is excluding shipping:

$2024 x 24 = $48576 is the total price of 24x ASIC devices.

$48576/$3585 = 13 months, which is a payback period of 24x Ebang devices excluding electricity costs. This is a little bit more than a year with due consideration of current cryptocurrency rates.

one of the most productive devices on the current market;

10 nm chips;

low power consumption factor.

high noise level;

considerable weight;

long delivery time.

The production of the third Terminator by Innosilicon officially starts in January 2019. The company calls it a “#1 BTC miner of 2019”. Pre-ordering started on November 11, 2018. The nearest deliveries are scheduled for March 5-15. Theoretically it takes the second place among the analogues in terms of profitability.

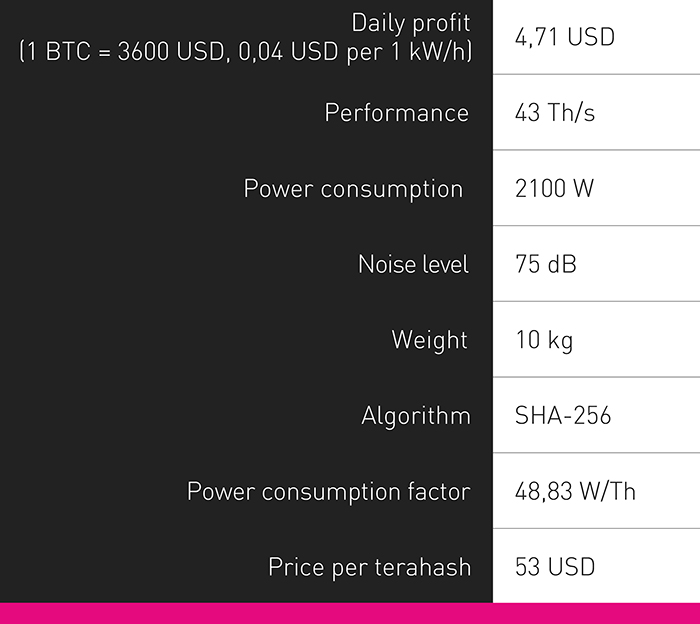

.jpg) The main characteristics of INNOSILICON Terminator 3 (T3-43T):

The main characteristics of INNOSILICON Terminator 3 (T3-43T):

Considering a 4 cents per 1 kW/h, a monthly profit from one miner equals $141.3. Let’s take a closer look at monthly profit and payback period of 24x ASIC Terminator 3 (T3):

24 x $141.3 = $3391 is monthly profit from 24 devices.

The cost of one T3 on the manufacturer’s website equals $2279, excluding shipping:

$2279 x 24 = $54696 is the total price of 24x ASIC devices.

$54696/$3391 = 16 months, which is a payback period of 24x Ebang devices excluding electricity costs.

ASIC Boost included;

7 nm chips by Samsung;

optimal power consumption factor

long payback period;

large dimensions and considerable weight;

irregular supply.

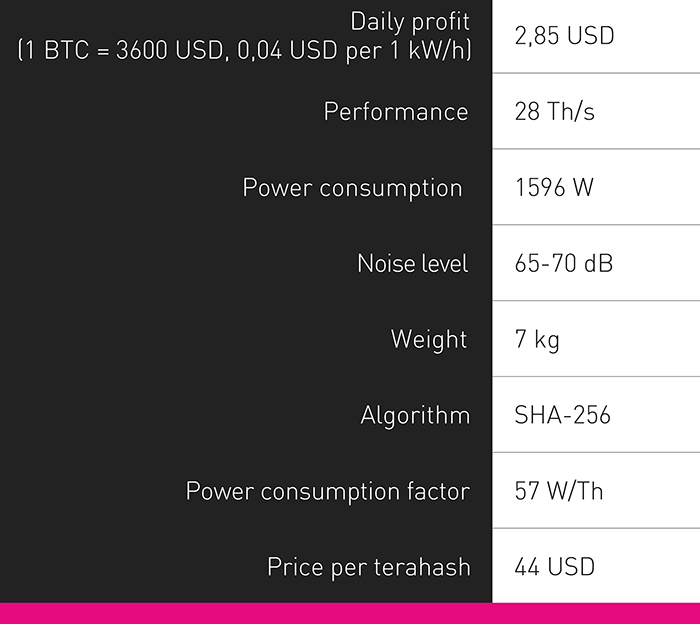

One of the most notorious past year premieres was another Bitmain creation. Even that S15 and T15 models were released simultaneously, mining with T15 model currently is not profitable. S15 model, on the other hand, has a feature which grants an ability of choosing one of two modes— energy-saving and high-performance. We are interested in high-performance mode (28 Th/s) with the energy consumption of 1596 watts.

Considering a 4 cents per 1 kW/h electricity rate, a monthly profit from one miner equals $85.5. Let’s take a closer look at monthly profit and payback period of 24x S15 model units:

24 x $85,5 = $2052 is monthly profit from 24 ASIC devices.

.jpg)

The cost of one S15 device on the manufacturer’s website is $1249, that is excluding shipping:

$1249 x 24 = $29976 is the total price of 24 ASIC devices.

$29976/$2052 = 14 months, which is a payback period of 24x S15 devices excluding electricity costs. This is a little bit more than a year with due consideration of current cryptocurrency rates.

a reputable manufacturer;

7 nm chips per individual project;

light weight.

profit at current crypto rate is not the highest;

power supply unit is bound to the miner on software level;

no factory overclocking.

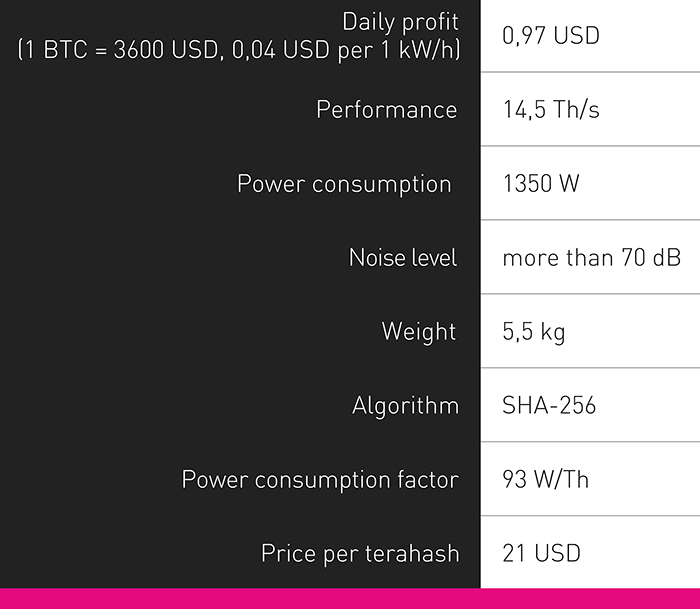

This is the last representative of the legendary S9 series, which presented a lot of great features. For two years, S9 miners have remained best sellers. Excellent technical specifics, reduced weight and compact dimensions were appreciated by many users. So what is it capable of in 2019? Let’s find out.

Considering a 4 cents per 1 kW/h, a monthly profit from one miner equals $29.1. Let’s take a closer look at monthly profit and payback period of 24x S9j model units:

24 x $29.1 = $698.4 is monthly profit from 24 devices.

.jpg)

The cost of one S9j on the manufacturer’s website equals $392 without shipping:

$392 x 24 = $9408 is the total price of 24x devices.

$9408/$698.4 = 13 months, which is a payback period of 24x S9j devices excluding electricity costs — slightly more than a year with due consideration of current cryptocurrency rates.

well-known and reliable model;

there are post-consumer purchasing options;

compact size.

outdated technological process;

high power consumption with low performance;

high noise level.

So what an average miner, say the owner of 20-30 units of S9 ASIC model shall do in 2019?

Switch to new models or stay with old ones, but give them a new lease of life with the aid of immersion cooling? We will try to consider all the options with one year perspective given that the electricity cost is $0.04 per 1 kW/h.

Summary table for 24 ASIC devices:

Same calculations, but excluding electricity costs for maintaining the comparative integrity.

Same calculations, but excluding electricity costs for maintaining the comparative integrity.

Antminer S9j (a 2 kW PSU in AsicBoost mode to be exactly). On the manufacturer’s website, price for an ASIC without PSU is currently $307. The price of PSU only is $90 at most. ASIC with a standard PSU costs $392. When overclocking, an additional power in the amount of 93 watts is required per 1 terahash. Therefore:

Antminer S9j (a 2 kW PSU in AsicBoost mode to be exactly). On the manufacturer’s website, price for an ASIC without PSU is currently $307. The price of PSU only is $90 at most. ASIC with a standard PSU costs $392. When overclocking, an additional power in the amount of 93 watts is required per 1 terahash. Therefore:

Our rack ($6000) + 24x new PSUs ($2160) = $8160

New ASIC with standard PSUs (24 x $392) = $9480

Staying in mining is much more profitable when acquiring a rack and new power supply units rather than buying new ASIC devices assembled.

Thus, even in the case of free F-hole, investments in new S9j will hardly pay off in the first year and only the old ones within BiXBiT immersion cooling are able to bring the real profit. And this statement bypasses the cost of industrial ventilation and conditioning for the standard air cooling method. We only hope that the current cryptocurrency rate will not remain the same, as its growth will proportionally speed up the payback period for any BiXBiT solution so that miners could reach a clean profit point faster.

Other disadvantages of buying new asic devices now:

Advantages of staying with old models applying the immersion cooling method:

Start mining with profit applying the immersion cooling from BiXBiT!